Your plan for your family and the real economy

An open-ended investment fund under the Italian Law falling within the aim of the Directive 2009/65/EC. A fund meant for long-term savings plans.

Why should you invest in the fund?

Individual Savings Plans (PIR) are a medium-long term investment with a fiscal incentive to channel private savings to Italian companies, and in particular to small and medium-sixed enterprises.

The Generation Dynamic ISP fund pays particular attention to the small cap part to initiatives of interest in the territory of the Trentino - South Tyrol Region, thanks to the expertise gained by the PensPlan Invest SGR S.p.A. now Euregio Plus SGR S.p.A. manager.

Fund investment advantages

100% tax relief on the investment income and other income, as well as inheritance and gift tax.

Investment fund constraints

It’s a medium to long-term investment. Units in the Fund must be held for a period of at least 5 years to benefit from tax exemption.

The plan is established with the allocation of amounts not exceeding 40,000 Euros per year and within a total limit of 200,000 Euros.

Each individual may not be the holder of more than one savings plan except in the case of plans established with the same intermediary.

Should constraints not be observed

Should you sell the Fund’s units before the statutory deadline, the ordinary taxation (26%) on the income from the investment must be paid, no penalty is applied.

Investment objectives and policy

The Fund is of a balanced type and aims, through active management, at a dynamic increase in the value of the capital, investing mainly in the system of the Italian companies, with a medium/long-term perspective.

The Fund’s units are among the investments eligible for an “Individual Long Term Savings Plan (ISP)” under the Italian Budget Law 2017 (Law no. 232 dated December 11, 2016).

The SGR pays particular attention to the use of financial instruments of an equity, bond, and monetary kind of subjects in the Trentino - South Tyrol Region. The Fund may invest in financial instruments issued or guaranteed by the Trentino - South Tyrol Region, the Autonomous Provinces of Trento and Bolzano, and public or private law entities controlled or guaranteed by the same.

As of 27/09/2023, among other things promotes environmental and/or social characteristics or a combination thereof by also investing in companies that comply with good governance practices pursuant to Article 8 of Regulation (EU) 2019/2088 (SFDR).

The product therefore qualifies as a financial product promoting environmental and social characteristics within the meaning of Article 8 of Regulation (EU) 2019/2088 (SFDR).

Sustainability disclosure

This financial product promotes environmental or social characteristics, but does not have sustainable investment as an objective. The Fund may invest in sustainable and environmentally friendly assets in accordance with Regulation 2019/2088 (SFDR) and Regulation 2020/852 (EU Taxonomy), but such investments are not in themselves decisive for the pursuit of environmental and social characteristics.

The decision-making process that evaluates the investments the Fund may be exposed to involves analysing environmental, social and governance aspects in addition to economic and financial aspects. This process makes it possible to examine the ESG (Environment, Social, Governance) profile of the countries and companies issuing the instruments being invested in, to assess their relative exposure to ESG risks and to monitor the management of related areas of opportunity and vulnerability.

The inclusion of the ESG profile analysis within the investment process is therefore the main tool for the product to assess and guarantee a perceptible degree of sustainability in its investments and financially support sustainable development. Strategies for the inclusion of ESG factors within the investment activity, and thus the promotion of the environmental and social characteristics of investments made, are based on methods developed internally by the AMC and use metrics consistent with the guidelines provided by the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy in terms of controlling and reducing the principal adverse impacts (PAIs) on the sustainability of the investments and the promotion of sustainable and environmentally-friendly investments. These strategies are differentiated according to the characteristics of the instruments being invested in (mainly by differentiating instruments issued by government or corporate issuers) and consist primarily of exclusion and best-in-class strategies.

![]() For more information on how the product promotes environmental and social characteristics, see the Disclosure pursuant to Article 24 of Regulation (EU) 2022/1288.

For more information on how the product promotes environmental and social characteristics, see the Disclosure pursuant to Article 24 of Regulation (EU) 2022/1288.

Financial instruments

Investment object

Bonds and shares, including those not traded on regulated markets or multilateral trading facilities, issued or stipulated by companies carrying out activities other than real estate, resident in the territory of the Italian State, or in EU Member States, or in States members of the Agreement on the European economic Area with permanent establishment on the Italian territory.

Investments in financial instruments of an equity nature may be made for a value not less than 51% of the total net value of the Fund. The financial instruments are mainly denominated in Euros.

Costs

The incurred expenses shall be used to cover the costs of running the Fund, including the costs of marketing and distribution of the Fund.

Investors may inquire about the actual amount of the subscription fees from their financial advisor or distributor.

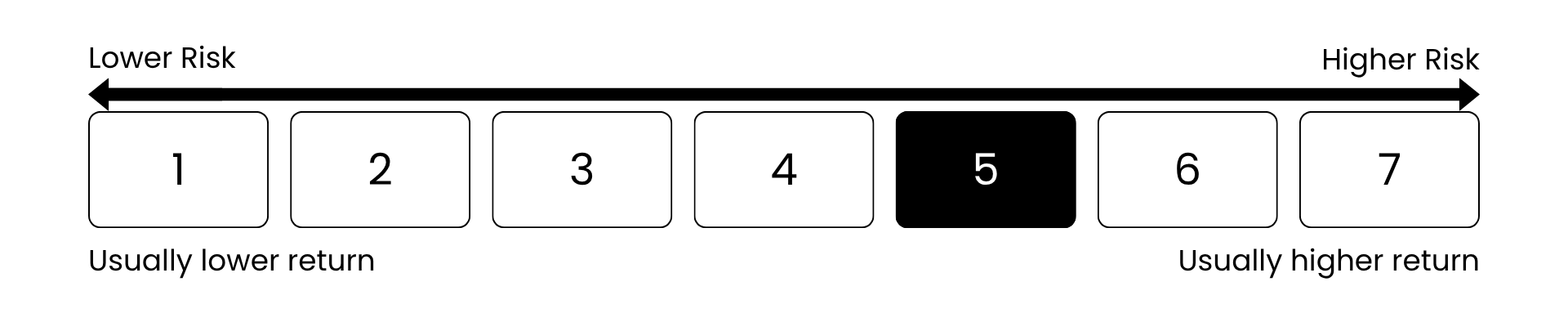

Risk and return profile

The historical data used to calculate the Synthetic Indicator may not be a reliable indication of the future risk profile of the Fund.

The Fund has been classified in the Category 5 as variability in weekly returns achieved over the past 5 years is 10% and 15% (for instruments with less than 5 years of operation, the estimate uses the first available year’s return for the period prior to the beginning of the operations).

The shown risk/return category may not stay unchanged and therefore the Fund’s ranking may change over time. The lowest category of the indicator does not indicate a risk-free investment.

Other risks of significant importance to the Fund are contained in the prospectus and the KIIDs.